Divine Solitaires announced the opening of its maiden seed funding round, targeting $10 million in seed fundraise

SUMMARY

Divine Solitaires has declared a maiden seed funding round in a strategic step to redefine the scenario in the Indian diamond industry. The natural diamond solitaire brand, with its headquarters based in Mumbai are proposing an investment of $10 million to give it a new level of boost and establish itself as a market leader in the niche solitaire market.

Primary objective and capital allocation

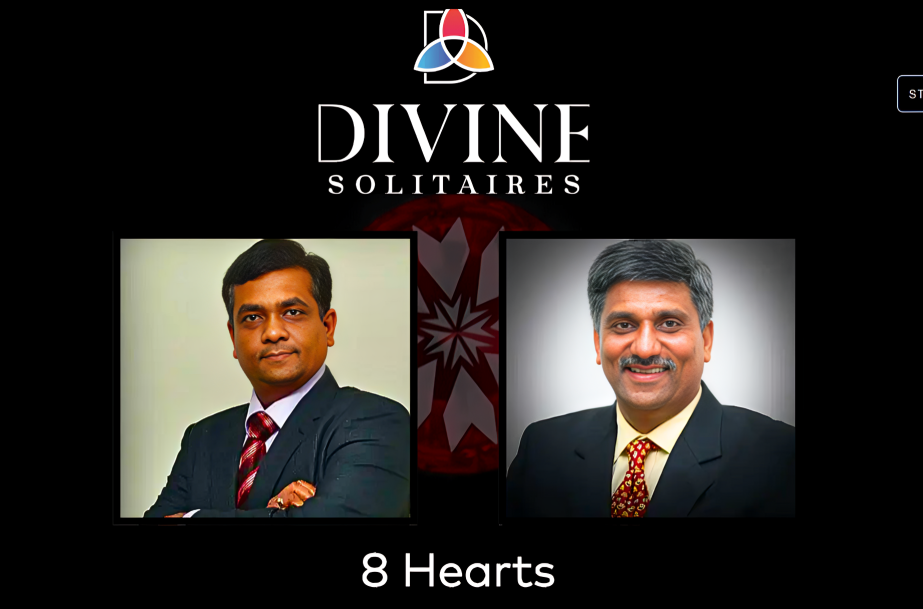

The main aim of this fundraise is to grow Divine Solitaires to a $250-300 million business in three or four years to come out of its present state. The brand, which was established in 2006 by Jignesh Mehta and Shailen Mehta, has also found its niche in specialising in natural diamond solitaire jewellery, and has left the more unstructured diamond market behind.

In India, the solitaire diamond jewellery market is currently pegged at 10-15 years with an amount of between ₹25,000 and ₹30,000 crore and a stable annual growth rate of 10-12%. Divine Solitaires, being the sole brand of the category fully committed, seeks to attain an impressive market share of 20-25% within the next five to seven years. The brand currently serves a strong customer base, and it is increasing it at the rate of about 15,000-20,000 new customers every year, with over 35% of them being first-time diamond purchasers.

The management has also laid down a clear roadmap in which the $10 million capital is to be deployed. It is set to spend around 60% of the fund on intensive brand-building and awareness campaigns. Although the company has a solid base in terms of the quality of its product, it has noted a gap in consumer awareness, which it needs to fill to meet its aggressive selling goals.

The remaining 40% of the investment shall be allocated to some of the operational and infrastructure priorities. Working Capital Optimisation, which guarantees a smooth supply chain to keep abreast with the increasing customer demand for solitaires. Technology and IT Upgrades, developing digital capabilities to provide an omnichannel retail experience. Team Expansion, hiring of specialised talent to handle the estimated expansion in different business areas.

Operational efficiencies

Divine Solitaires is already financially sound, with its profitability increasing by 30% over the last year. This has been sustained by the efficiencies in operations and the strategic unveiling of new product categories. The brand has also diversified to accommodate a more varied demographic by extending its portfolio to fancy color diamonds, various shapes and smaller-sized diamonds.

The firm is also diversifying its value propositions by launching diamond coins as a contemporary alternative to the traditional gold coins when giving gifts. Although the brand employs an omnichannel strategy, it is almost entirely through its wide network of offline that the brand manages to produce approximately 95% of its business. Divine Solitaires has deployed a shop-in-shop business approach in 215 partner stores in 108 cities, which gives it an enormous physical presence in both the metro and tier-II/III markets.

Conclusion

The move to raise $10 million as seed capital will be a turning point for Divine Solitaires. The combination of its strict quality policies, with all its diamonds graded on 123 parameters, and a new injection of capital will witness the brand shift out of a successful niche player to a formidable retailer. Since it is aimed at a multi-million dollar valuation, the transparency, technology, and brand consciousness that the company has developed will be decisive in the untapped potential of the growing demand for natural high-quality diamonds in India.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.