CapitalXB raised $15 million in a funding round led by Alken Founder Nicolas Walewski

SUMMARY

CapitalXB, a trade finance company based in Mumbai, has been able to complete a major round of funding, raising $15 million. This long-term capital injection, a judicious combination of debt and equity, is to avert the financial strength of the company, that is, to enhance its lending capacity, and enable it to upgrade its basic technology base significantly. The investment indicates that there is a high degree of investor confidence in the model of CapitalXB and its objective to solve the major financing gap in the Indian economy.

Leadership and operational goals

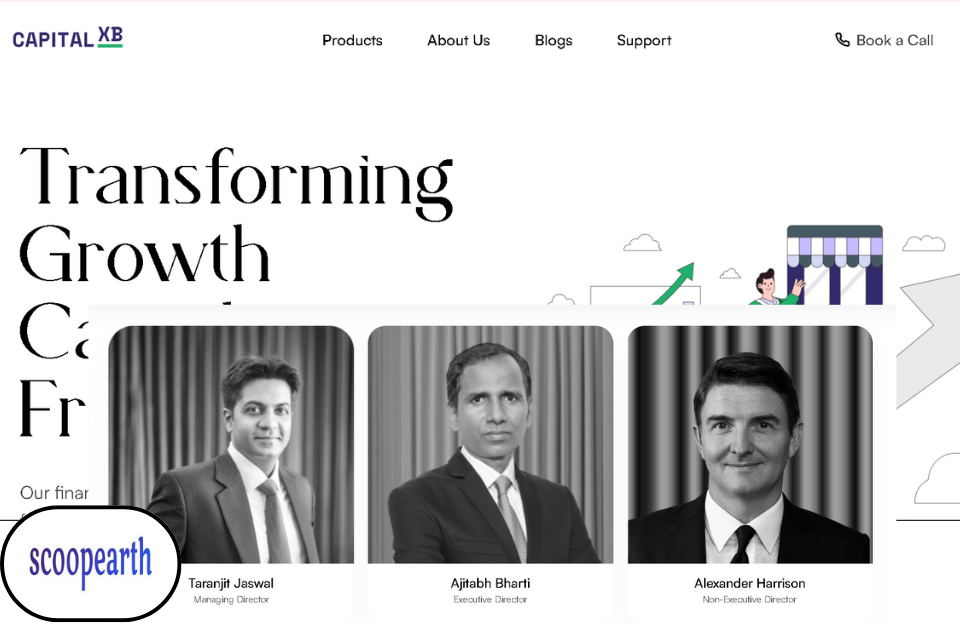

Taranjit Jaswal and Ajitabh Bharti are the founders of CapitalXB, which was founded in 2024. Being a regulated participant in the financial sector, the company is a Non-Banking Financial Company (NBFC), which is licensed as an NBFC-Factor within the regulatory control of the Reserve Bank of India (RBI).

The finance was raised during a critical financial round led by one of the most reputable personalities in the European financial markets: Nicolas Walewski, founder of the London-based investment boutique Alken. Nicolas Walewski took part in this round personally. This lead investment proves to be a major private support to the business strategy and market potential of CapitalXB.

CapitalXB has a strategic need to inject capital because its short-term objectives in the operation are to grow its operations and greatly increase its presence in the Indian manufacturing and trade industries. The core mission of the company is to make accessing working capital by SMEs possible, which is a direct response to a significant issue found in the government data. This information approximates a significant shortfall in trade finance in the country, standing at an incredible $525 billion. CapitalXB is planning to cut a very specific and successful niche in this vast market by concentrating its efforts on its technology-driven, inclusive finance.

The company provides an entire range of funding solutions to businesses involved in trade. These products consist of vital financing instruments, which are invoice discounting, factoring, and supply chain financing. CapitalXB is a cross-border trade credit facility that has served as a solution to the growing international trade of Indian businesses.

CapitalXB is also a registered user on the TReDS (Trade Receivables Discounting System) platform that is governed by the RBI. This platform aims at assisting the Micro, Small, and Medium Enterprises (MSMEs) in obtaining working capital in time by discounting the trade receivables, thus putting liquidity into the supply chain in a fast and efficient manner.

Image Source: Entrepreneur

Utilization of AI and the competitive market

One of the major strengths of CapitalXB compared to competitors is that it is highly dependent on a contemporary and digital lending platform that will be complemented by innovative Artificial Intelligence (AI). It is planned to be constructed with the application of Agentic AI to evaluate the credit in-depth, which will encourage more precise and quicker risk analysis.

Direct communication and assistance on the part of the company are conducted through conversational AI when engaging with suppliers. These AI technologies are supposed to be integrated to enable quicker decision-making processes and eventually provide a much better customer experience to its clientele.

CapitalXB is also joining an already competitive market in trade finance, especially in the TReDS ecosystem. The current players on the TReDS platform, including M1xchange, A.TREDS, and Receivables Exchange of India Ltd (RXIL), have significant transactions, which amount to almost ₹25,000 crore on an average monthly basis.

There is high rivalry in this sector, but CapitalXB has faith in its potential to distinguish itself. The company will ensure that it reaches the market by having a consistent concentration on its technology-based strategy, which will see it offer inclusive financing solutions that are highly tailored to the needs of the fast-growing SME ecosystem in India.

The CEO and Managing Director of CapitalXB, Taranjit S Jaswal, said, “India’s SMEs are poised for unprecedented growth. This funding accelerates our mission to become the preferred financing partner for businesses driving India’s manufacturing and export economy, enabling economic multipliers across entire supply chains.”

Quotation Source: Entrepreneur

Conclusion

The achievement of the raise of $15 million in a mix of debt and equity, spearheaded by Alken founder, Nicolas Walewski, puts CapitalXB at a strategic standpoint in the Indian trade finance market. CapitalXB is actively targeting to solve the estimated credit crunch in India of $525 billion with its innovative technologies, such as Agentic AI to conduct credit assessment and actively engage in the TReDS platform to position itself as a technology-oriented, favorable financing partner to the growing SME community in India.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.