EDF Investment is significantly investing ₹257.77 crore into eight distinct Daughter Funds and generating over 23,600 jobs across India

SUMMARY

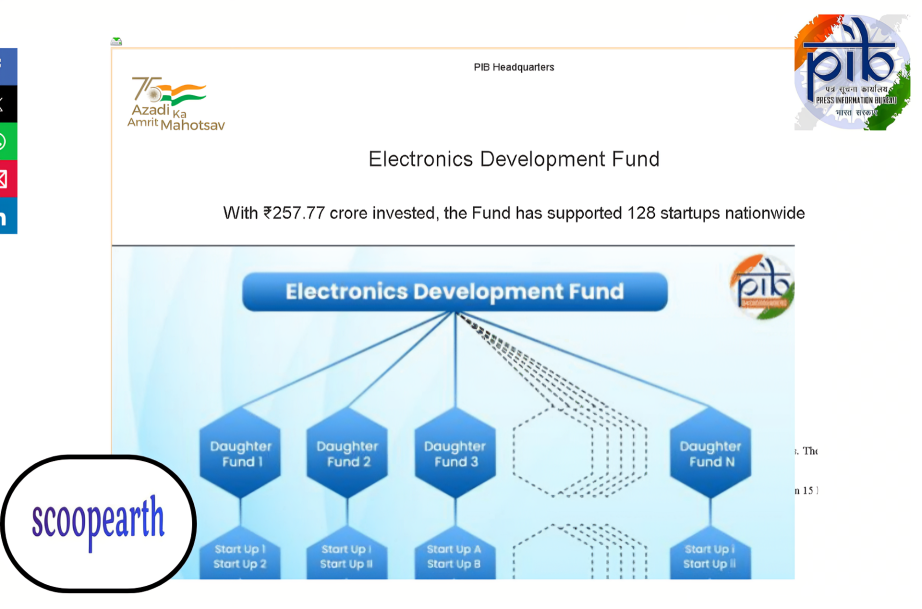

The Electronics Development Fund (EDF) has been a significant milestone in the Indian technology scene, by investing ₹257.77 crores in eight separate Daughter Funds. This capital inflow has been strategic in enhancing the tech startup ecosystem in the country, which has led to the establishment of more than 23,600 jobs in India. Having been formally introduced on February 15, 2016, the initiative of the government remains an important mechanism behind directing the required risk capital to innovative projects, with the end goal of making India a global center of high-tech innovation and the creation of intellectual property.

Enhancement and financial commitment

The core mission of Electronics Development Fund is well formulated and strategically oriented towards various areas that are crucial to technological self-reliance in the country. The fund was also created with a general objective of encouraging high-level research, strategic development, and invaluable entrepreneurship in the sectors of electronics, nano-electronics, and information technology.

One of the key pillars of the EDF mandate is to substantially increase India as a source of design and development in the critical Electronics System Design and Manufacturing (ESDM) business. This emphasis is not only to develop domestic talent but also to establish a strong manufacturing base, a self-reliant one.

The economic and technological effects of the Electronics Development Fund’s financial investment have been huge and measurable. The direct investment made by the EDF of ₹257.77 crore in the eight Daughter Funds has acted as seed capital, which has been multiplied through the startup space. With this early support, the Daughter Funds have uniformly invested a large sum, totaling ₹1,335.77 crore, in a large range of 128 startups and ventures.

The result of this strong financial implementation is complex. However, the funded projects have generated more than 23,600 employment opportunities across India, which can be seen as a considerable impact on the generation of employment in the high-tech industry.

This emphasis on the development of intellectual property has had tangible outcomes, as the startups have produced or acquired 368 intellectual properties (IPs) in total. The EDF has been able to facilitate the active financing of consistent access to risk capital to startups that are fundamentally operating on advanced technologies, which makes a direct and valuable contribution to increasing domestic design capacity and the development of valuable intellectual property in the country.

Advanced technological domains

The startups funded by the Daughter Funds are not concentrated on traditional technology sectors but are rather innovating in the new, leading frontiers sectors. These sponsored initiatives are prolifically working on solutions in fields like the Internet of Things (IoT), Robotics, Drones, Autonomous Vehicles, HealthTech, Cyber Security, and Artificial Intelligence and machine learning (AI/ML). This focused action on high-tech areas plays a key role in achieving the greater national goal of making India an innovative hotspot of high-tech development in the international arena.

The capability of the Daughter Fund model to provide returns in addition to its developmental objectives is an important measure of the success and sustainability of the model. The Daughter Funds have proven to be financially viable with their ability to implement exits out of some of their portfolio. They have divested 37 investments already, and this has brought impressive returns. The overall returns achieved by these successful exits have been ₹173.88 crore, and this confirms the success of the investing strategy and the maturity of the startup ecosystem beneath it.

Conclusion

The ₹257.77 crore investment of the Electronics Development Fund in eight Daughter Funds does not merely indicate a financial investment, but it is a strong sign of the government’s commitment to developing a technological ecosystem that is future-ready and independent in India. Through the issuance of more than ₹1,335 crore in 128 startups, the EDF initiative has not only created more than 23,600 jobs and 368 Intellectual Properties, but has also guided the entrepreneurial power of the country towards the critical frontier technologies. The long-term success of the EDF has contributed to market-based innovation and strengthened the position of India as a global player in high-tech technology.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.