TCS shares witnessed substantial transactions on the NSE involving a block trade of ₹76.07 crores

SUMMARY

The stock of Tata Consultancy Services (TCS) recently experienced a large transaction at the National Stock Exchange (NSE), which involved a block trade worth ₹76.07 crores. With these sizeable trades, market participants are used to paying attention, so that this may yield some insight into the moves of large traders as well as the institutionalized feeling towards one of the top Indian information technology (IT) services companies.

About TCS

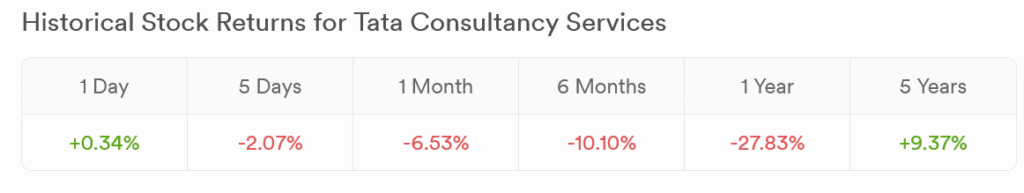

Tata Consultancy Services (TCS) is considered to be among the largest IT services and consulting firms in India, boasting a robust global presence and a wide range of technology solutions. Being one of the highest performing stocks in the Indian market, TCS is a major index component. Its stock performance continues to be the focus of investors and market analysts, and big trades like this block deal are a good, albeit limited, source of insight into market dynamics and investor positioning in the technology industry.

Data Source: ScanX

Block trade and market implications

The TCS shares block deal was done in the NSE and entailed a large amount of company stock being traded. It involved the sale of 256,514 shares of Tata Consultancy Services. These shares were traded at ₹2,965.60 per share. The sum of these numbers led to the overall transaction amount of ₹76.07 crores.

A block trade is described as a single transaction with a significant amount of securities, especially a pre-determined transaction between two major institutional investors. These transactions bypass the standard trading window by their nature to reduce the market impact, although they are required to follow certain exchange regulations concerning transparency and price discovery.

The amount of shares sold, the price, and the total value were publicly announced, but the names of the individuals who sold and bought the shares in this specific TCS transaction were not made public. Such trades usually involve this non-disclosure, and the market is left to guess who and why is transacting.

Market analysts often consider block trades, particularly those of such scale in a company of high value in the market, as a sign of possible institutional interest or a significant shift by a major shareholder. The massive size and worth highlight the ongoing trust or reallocation of the stakes by key players in the IT giant.

Though the transaction is significant, a block deal itself does not always indicate a shift in the performance of the company or in the market attitude towards the stock. These are often internal portfolio changes or large fund strategic exits/entries. These transactions are not typically recommended by investors to be considered in isolation from TCS operational performance, market valuation, and long-term prospects as a solitary indicator of investment decision-making.

Conclusion

The block trade of 256,514 shares of TCS, amounting to ₹76.07 crores at the National Stock Exchange, is a significant deal, indicating a high amount of capital flow in the stock. The transaction was at a price of ₹2965.60 per share and marked a significant change in ownership, which could be instigated by institutional investors. Since the identity and strategic intentions of the parties to the transaction are not disclosed, the exchange is a relevant indicator of high-volume market transactions and must be considered in conjunction with the business core and market trends of the company.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.