Subway India operator EverBrands secured $15 million in a fresh funding round led by Playbook Partners

SUMMARY

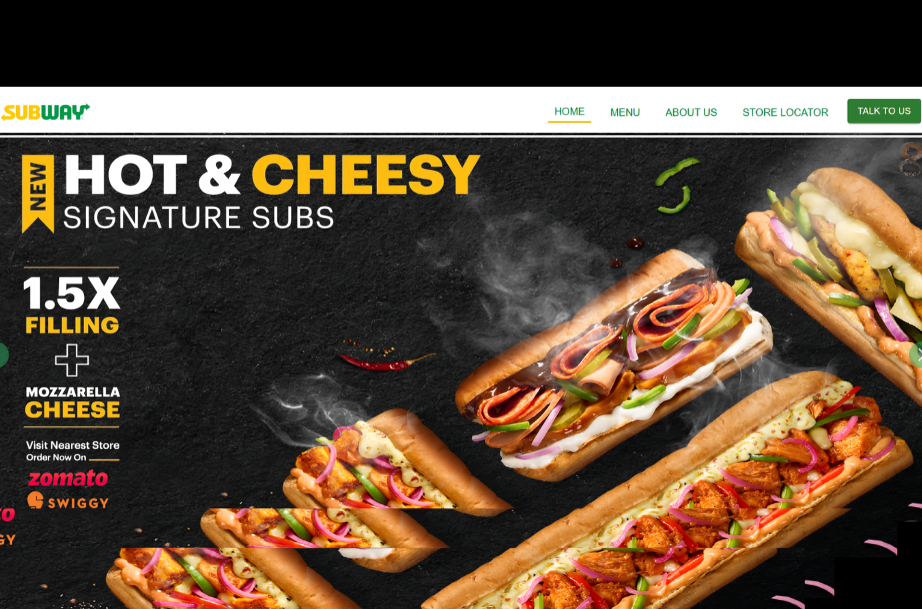

In an initiative to control the Indian quick-service restaurant (QSR) and cafeteria horizons, the operator of Subway and Lavazza, as well as other reputable brands in India, EverBrands, has raised $15 million in a fresh funding round. The initiative was led by Playbook Partners, a growth-stage venture capital firm. It is an important milestone in the process of establishing a strong, multi-brand food and beverage platform by EverBrands.

Newly secured capital and primary objective

The freshly acquired capital will be used in the aggressive growth of the portfolio of EverBrands in India. The company is an entity of the Everstone Group that is engaged in a wide variety of better-for-you food and beverage domains. It has a subsidiary called Culinary Brands, which deals with the Subway master franchise in India, Sri Lanka, and Bangladesh. It manages Lavazza Coffee, Fresh and Honest (F&H) Coffee, and the distribution of Dilmah Tea by Fresh and Honest Café Private Limited.

The primary objective of this investment of $15 million dollars is to maintain the technology infrastructure and the size of operations in the company. Through the experience of Playbook Partners in tech-enabled growth, EverBrands will be able to sharpen its service delivery and target a wider group of demographics in the city that are becoming more interested in fresh, customizable, and high-quality dining choices.

Growth momentum and partnership

The investment is timely when Subway India is enjoying unprecedented growth. The brand has also recently achieved a significant milestone by becoming the first brand to open its 1,000 th store in Gurugram, cementing its status as one of the fastest-growing up-market QSR brands in the nation. With the brand already increasing by an average of two new stores per week in the past three years, the growth has been unabated since the acquisition of the master franchise in 2021 by the Everstone Group.

Subway has grown to over 165 cities under the leadership of EverBrands and employs in excess of 3,500 employees. It has shifted its strategy more toward penetration into Tier II and Tier III markets, leaving the traditional mall-based sites to high-street, neighborhood, and transit-oriented formats such as airports and office parks. This decentralization will enable the brand to be part of the everyday Indian diet and will include, as part of its menu, more health-conscious choices that are directed at growing health awareness in the country.

Playbook Partners, under the leadership of the former Reliance Jio executive Vikas Choudhury, is the third significant investment in EverBrands that the firm has undertaken in India since the fund first closed in 2017. The VC company specializes in mid-market enterprises that are willing to grow through digital and technological advantage. The collaboration is likely to speed up the digitalization of EverBrands, especially in the optimization of its “Point and Order” systems and the improvement of its delivery network, which now contributes a major part of QSR transactions in India.

Everstone Group, which manages approximately $8 billion of funds, is still relying on EverBrands to integrate its F&B portfolio. The long-term vision is to expand the Subway presence by almost twice to a total of 2,000 outlets within the next five to six years. This financial injection is the so-called belief capital needed to keep this course and yet provide unit economics stay afloat in its diverse forms of cafes and restaurants.

Conclusion

The Playbook Partners-led $15 million funding round will be a key milestone in that EverBrands will grow beyond its rapid expansion approach of stores in the region and enter into a period of technology-focused operational efficiency. With the legacy of the world brands such as Subway and Lavazza, combined with the knowledge of local execution and new capital, EverBrands is poised to spearhead the next wave of the QSR revolution in India.

This investment underlines the strategic value of the Indian food services market as a high-growth area to both international and domestic investors since the company is considering a possible public listing in the future.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.