Wakefit is targeting a substantial ₹1,400 crore IPO, following a significant plan for ₹200 crore pre-IPO fundraising

SUMMARY

The home-furnishing startup, Wakefit, based in Bengaluru, is making a giant leap on its way to an IPO, purportedly preparing a massive Initial Public Offering (IPO) worth ₹1,400 crore. This action, which places the company in the market at the beginning of December, is an indication of a significant rise in its financial aspirations as opposed to its original intentions. To accompany this significant public offering, the company has also made strategic plans to raise an additional ₹200 crore of funds in a pre-IPO fundraising round to be raised by a mix of foreign and domestic institutional investors, indicating a high level of confidence in the growth path of the company.

Primary capital raise and OFS component

The process of Wakefit leading up to the IPO listing had earlier started in the year when the company first submitted its draft papers to the market regulator, way back in June. During this first filing, the company was aiming to raise the primary capital of ₹468.2 crore. The declared purpose of the usage of these initial primary funds was narrowed down to the increase of the physical location of the company, with an aim to increase its number of stores to over twice as many as it currently has in the country. This intended expansion was a clear sign of the dedication of the company to a hybrid sales support that was a combination of online and offline sales points.

Upon the first filing, the size and dimensions of the whole issue have been revised significantly upward. The overall issue size has increased exponentially to ₹1,400 crore, which has been achieved upon the addition of the secondary transactions and the primary capital raise. The latter form of public listing is therefore a combination of a fresh equity issue by the company and an Offer-for-Sale (OFS) by the current stakeholders. In order to handle this high-risk initial public offering, Wakefit has engaged the firms of other key financial institutions to become the advisors for the complete procedure of this issue. Axis Capital, IIFL Securities, and Nomura are the companies.

The proposed pre-IPO round will be a major component of the capital mobilization plan of the company. This round will come with the aim of raising ₹200 crore in particular, by key foreign and domestic institutional investors, a move that will enable the company to raise capital and possibly stabilize prices before the actual roadshow in the IPO process. This curiosity among a combination of institutional investors, both local and international, constitutes the evaluation of the market potential of Wakefit in the rapidly growing home furnishings market. This capital will play a critical role in sustaining the general development and business needs of the Bengaluru-based business as it becomes a publicly listed business.

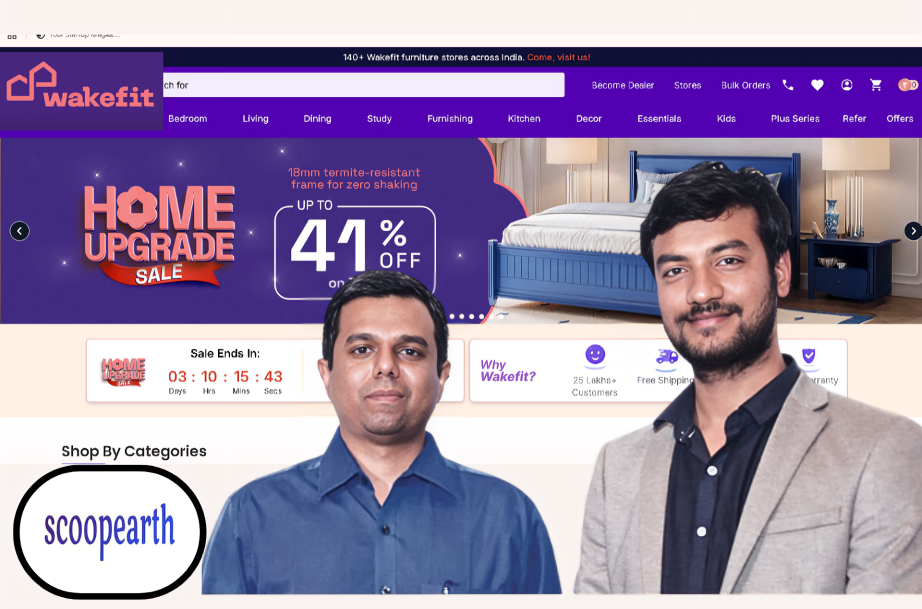

A high Offer-for-Sale (OFS) element is also included in the ₹1,400 crore IPO, where previous current owners and investors are going to offload a portion of their holdings. This secondary sale of shares will involve an approximate sale of 58.4 million shares overall. The founders of the company, Ankit Garg and Chaitanya Ramalingegowda, are the sellers in this particular deal, and the significant amounts of private equity investors who have aided in the expansion of the company over the years.

Wakefit has had significant support among iconic financial institutions, having been able to raise several funding rounds between 2018 and 2023. Among the high-profile investors in this list are Peak XV, Investcorp, Verlinvest, Paramark KB, and SAI Global India Fund.

Core product profile and top-line growth

Wakefit was founded in 2016. Wakefit has become a significant competitor in the market of home furnishings. The product portfolio of the company involves a broad range of products such as mattresses, beds, sofas, and other products of home furnishings. The sales approach is based on the diversification principle, and it has expanded, reaching consumers by providing a robust mix of dedicated online-based stores, consumer-centrically located experience centers, and its own chain of stores owned by the company. This multi-channel has played a significant role in the growth and market penetration that the company has in India.

According to the details revealed in its draft prospectus, the company has displayed a significant financial magnitude built up to its IPO. Wakefit has indicated that it has earned a high income of ₹994.3 crore in the first quarter of the Financial Year 2025 (FY25).

The company reported a net loss of ₹8.8 crore at the same time of the year as it registered strong top-line growth. These financial metrics- a near ₹1,000 crore income and a small net loss- point to the scale of operations that the company has reached, and currently it is focusing on market growth and investment rather than on immediate profitability, a typical trend in high-growth technology and consumer start-ups that are about to go to the public markets.

Conclusion

The ultimate move of Wakefit to increase the IPO size to an enormous ₹1,400 crore, as well as the pre-IPO ₹200-crore round strategic planning, are a crucial and bold point in the lifecycle of the Bengaluru-based home-furnishing company. This is an intensified capital mobilization plan, which is placed in the context of an early December listing target, and which is robustly backed by an Offer-for-Sale by the key promoters and the leading major private equity investors. The numbers posted in the prototype prospectus, which imply an income of around ₹1,000 crore during the initial nine months of FY25, underscore the significant market penetration and size of the operations that the firm has achieved since its inception in 2016.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.