Ace International secured $35 million from Global Investors FMO, responsAbility, Incofin, and Fiedlin Ventures

SUMMARY

Ace International Limited is a well-established integrated food ingredient company that recently declared a significant breakthrough in its corporate history, raising $35 million (approximately ₹305 crore) from the international investors FMO, responsAbility, Incofin, and Fiedlin Ventures. This is a substantial capital injection, the first institutional raise for the company and is a landmark in its plans to expand its operations and further its business of specialised nutrition and dairy ingredients worldwide. This funding round closure is a testimony to increased international confidence in the integrated business model of Ace International and its ability to provide significant value to the global nutrition value chain and place India at the centre of it.

Investment from global investors and strategic expansion

The funding round of $35 million was remarkable as it involved several major international financial institutions and venture capital companies, indicating that there was a strong collective belief in the long-term vision of Ace International. Investors leading this funding were the Dutch entrepreneurial development bank, FMO, responsAbility, Incofin and Fiedlin Ventures. This varied team of international investors is not only contributing financial support, but will also contribute an abundance of strategic knowledge to the venture. Throughout the process, Inval Capital was the sole advisor to the entire process, and it was instrumental in actualising the deal.

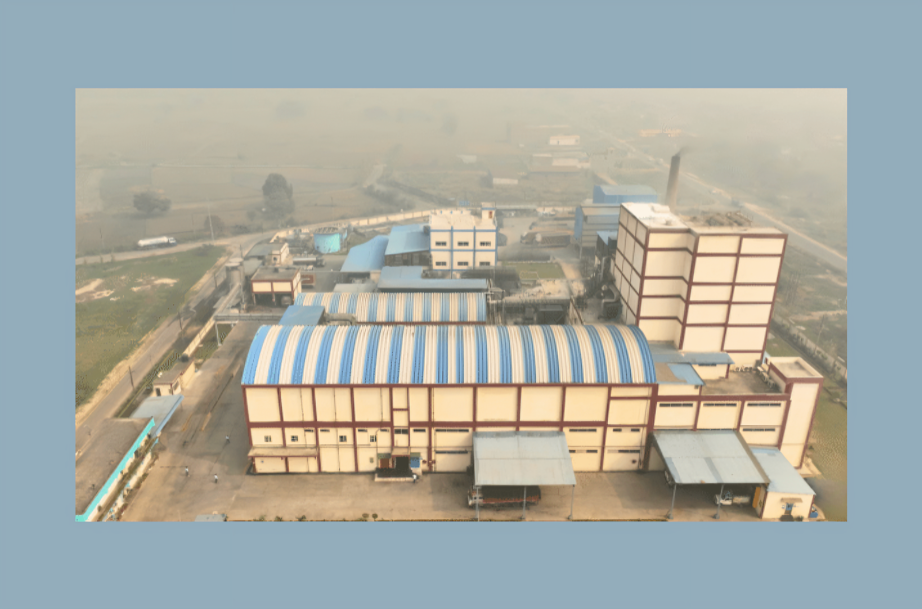

The totality of the funds collected will be dedicated to strategic infrastructure development that will completely change the production capacity of Ace International. The capital will be used to set up a green field, a full-fledged dairy ingredients and nutrition plant and a complex in Kuppam, Andhra Pradesh. This is an ambitious development and a huge investment in technology and infrastructural development in the region.

The future facility that the company envisions will involve the introduction of state-of-the-art new technology in the dairy nutrition processing into the wider Asian market, which would establish a new benchmark in the manufacturing of ingredients in this region. This new location will be strategically located not only to host the large-scale manufacturing capacities but also to help the company diversify into the whole new product lines in the functional and fortified nutrition area.

Kuppam complex is supposed to produce mainly highly specialised nutrition ingredients, which will be distributed to major food and nutrition corporations worldwide. The site was selected because it is located in a large agricultural area and has the advantage of available and established strong-tie logistics infrastructure, which provides sourcing and distribution efficiency.

Operational focus and rural empowerment

Ace International Limited is a company that was established and headed by Sanjeev Goyal due to a solid base of innovation and technological development in the food industry. The company has developed a successful 30-year history of being a family-owned business, and today it is a central distributor of a variety of highly specialised business needs, such as nutraceuticals, sports and infant nutrition, medical foods, beverages, and confectionery.

Its business is heavily entrenched in high-end processing, advanced automation and product innovation with a view to the functional and fortified nutrition market. The Kuppam complex is expected to have a social and economic impact that is widely spread, not limited to its technological achievements.

In the new destination, the company has committed a particular promise to work with over 40,000 farmers in its sourcing partnerships. It is this significant number of partners that will incorporate a significant number of women, a calculated decision that is meant to empower rural livelihoods and facilitate an inclusive growth in the agricultural supply chain. This is highly committed to involving smallholder farmers and encouraging sustainable sourcing, which is in line with ethical investment requirements of the involved global investors, making the facility a beacon of socially responsible economic development in the area.

Conclusion

The Ace International Limited case concerning the successful institutional fundraise of $35 million is a significant step in the right direction for the company, as it marks the beginning of the transition of the company from a family enterprise to a global supplier of advanced dairy ingredients. The capital injection from FMO, responsAbility, Incofin and Fiedlin Ventures is all strategically directed towards building the art, green field unit in Kuppam, Andhra Pradesh, which will bring revolutionary dairy nutrition processing technology to the Asian world. This huge investment is not just an exercise of corporate expansion, but a massive vote of confidence in the ability of India to emerge as a major player in the global nutrition value chain.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.