Truboard Partners secured ₹20 crore in a fresh funding round led by Earth Fund

SUMMARY

Truboard Partners is a leading company in providing solutions to asset performance management based on AI and has raised ₹20 crore in the recent funding round led by Earth Fund. The strategic investment is a milestone step in the company since it intends to improve its technology base and increase its presence in the real asset ecosystem.

This capital injection by Earth Fund, a venture capital platform specializing in sustainability and the built environment, highlights an increased institutional belief and support of AI-powered technologies aimed at professionalizing asset monitoring and management.

Fund utilization and the core of Truboard Partners

The capital will be used mainly to consolidate the company’s product base and enable a responsible platform expansion in different classes of assets. Through artificial intelligence, Truboard Partners hopes to fill the gaping holes of real and financial asset management, especially in the real estate and renewable energy industries. It is also an investment that underscores the growing need for advanced data analytics in areas that have historically operated on fragmented data and manual control.

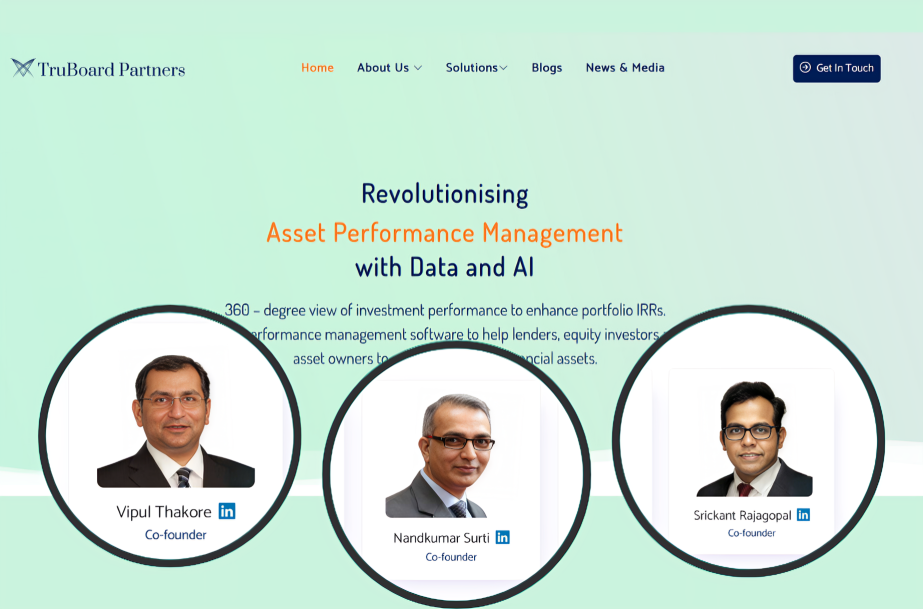

The main component of the Truboard Partners offering is an artificial intelligence-based asset performance management software, which offers a 360-degree perspective of investment portfolios. The platform has been tailored to support the requirements of lenders, equity investors, developers, and asset owners.

The software allows the stakeholders of a company to be more visible in terms of operational efficiency and risk management by simplifying the complex information points into actionable insights. Such transparency is important to contemporary institutional investors who need real-time data to maneuver through unstable market scenarios.

Reducing the reporting and visibility timelines is one of the greatest benefits of the Truboard platform. Lender visibility into asset performance used to require months, but with the Truboard technology, this can now be done within a few days.

This quick response enables faster decision-making and assists the owners of assets to create greater returns, which is commonly quoted to be a 2-3% improvement. The platform ensures that all parties to the lifecycle of an asset are aligned by one source of truth by offering a common operating layer to both debt and equity structures.

Leadership and expansion horizon

Earth Fund investment is especially interesting because it is the first time that capital is deployed by the venture capital company. Earth Fund has an institutionally sound institutional support comprising HDFC Capital Advisors Limited, as well as listed developers like Nila Spaces.

Individuals who sponsor the fund, such as Brigade Enterprises Ltd. and Gruhas, have been keen on the mission of the fund, which is to support technology-based solutions to the infrastructure of India. The collaboration between Truboard and the Earth Fund is founded on the common vision that the real management of assets must be performed with specific technology based on the specifics of the work of the built environment.

The leadership at the Earth Fund noted that the rationale behind investing with Truboard Partners has been its spectacular founder track record, institutional adoption, and the return on investment (ROI) that the platform provides. The complexity of the product means that it has high switching costs to clients, making Truboard a category-defining company within the asset management arena. The overlap between the sustainability targets of Earth Fund and the efficiency-focused platform of Truboard establishes a solid synergy that tends to transform the infrastructure monitoring of the Indian market.

Although Truboard Partners already has a robust presence in the Indian real estate and energy market, the company is seeking to expand to other regions of the world. The service is currently starting to penetrate the markets of the United States and the European Union, which is an indication of its scalability and applicability at the international level. This growth will be facilitated by the fact that the platform can handle multi-asset portfolios with a high level of complexity and can operate in various regulatory and geographical environments, making it a highly adaptable instrument among institutional investors globally.

The success of this funding round places Truboard Partners in a position to carry on with its innovation path. The company is responding to a long-term lack of transparency in the real asset sector by targeting the asset monitoring of post-investment assets. With the industry becoming more digitalized, AI-based platforms will play an even more important role in making infrastructure investments more long-term value-creating and sustainable.

Conclusion

The ₹20 crore funding by Earth Fund is a strong affirmation of the AI aspect of asset management by Truboard Partners. The process of turning fragmented data into intelligible, actionable information also offers the company not only the opportunity to enhance operational efficiency but also to improve the overall transparency of the real asset ecosystem in India and other areas.

With Truboard still scaling its platform and entering new markets, the cooperation with Earth Fund will probably become a key to reshaping the way institutional investors handle and optimize their portfolios in the digital era.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.