India’s Semiconductor Push: Vedanta and Tata in the Race

SUMMARY

Introduction:

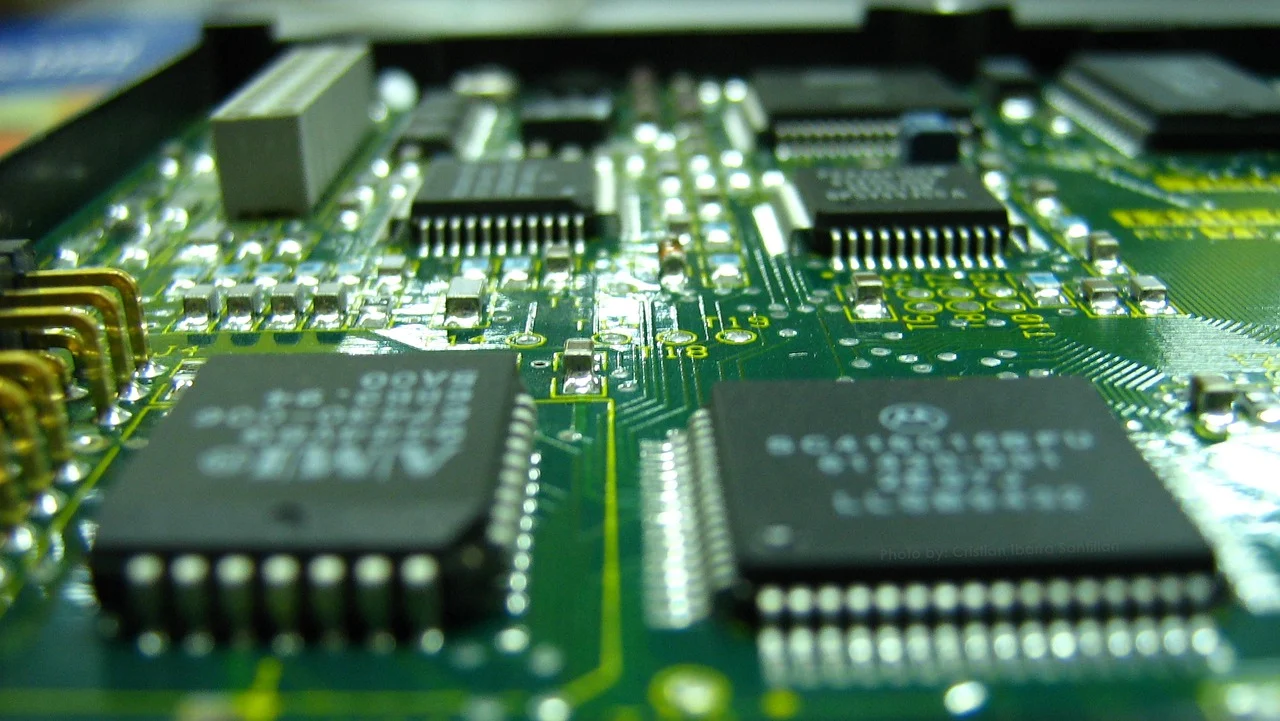

Semiconductors are the small electronic brains that go into gadgets like phones, laptops, and cars. They are a class of materials that exhibit intermediate electrical conductivity between that of a conductor and an insulator, and their properties can be controlled via external energy sources. India had been importing these chips for years and spent a large sum on doing so, but its supply was at risk amid global shortages.

Now, the country is on a mission to boost its own semiconductor industry. This is being led by the homegrown companies such as the Tata Group and Vedanta. They offer jobs, tech independence, and economic growth. As of late 2025, projects are advancing amid excitement and hurdles. In this article, we will examine how this race could help India shape its future in technology.

India’s semiconductor mission

India unveiled its Semiconductor Mission to build a home-grown semiconductor industry. The goal is to cut down imports, build factories, and train workers. In the past, India designed a few chips but never manufactured them, depending heavily on other countries like Taiwan and South Korea.

The Indian Semiconductor mission provides up to 50% funding for chips and display fabrication (fab) facilities with investments, as well as incentives covering land, water, and power. It aims at both the basic chips for appliances and the advanced ones for AI and EVs. By the middle of 2025, several projects were approved, prioritizing states with higher-quality infrastructure.

The government backed four major projects worth more than a billion in August this year. These include fabs and packaging units in Gujarat and Odisha. Demand for chips are growing with smart gadgets and electric vehicles. India’s semiconductor market is growing fast, and the mission wants to make India a top exporter.

What was the need for this?

The COVID pandemic showed the disadvantages of relying on foreign suppliers after worldwide chip shortages arose. Electric cars, artificial intelligence and 5G all took off, and demand for specialized chips that make those technologies work tripled. India currently has a $45 billion market in semiconductors as of 2025 and may double to $100 billion by 2030.

The aim is to reduce imports and transform India into one of the world’s major semiconductor export destinations. And this action will not only make India self-sufficient; it can also grow the nation’s economy. India is focusing on chip exports to build its market, find foreign partners, and grow a pool of talent. The mission is important in moving away from borrowing and toward making chips on our own, with a steady supply and lower costs.

Tata Group’s bold moves

Tata Group, the Indian company whose name is known for its cars, tea, and hotels in India, moved into semiconductors with Tata Electronics. They are not new to tech; they have been assembling iPhones in India, but semiconductors present a different challenge. They are building India’s first major chip factory in Dholera, Gujarat, partnering with a Taiwanese firm, Powerchip Semiconductor Manufacturing Corporation, for expertise.

This is a major project to produce chips for consumer electronics and autos, starting operations around 2026-27. They are investing Rs 91,000 crore in this project. They aim to make around 50,000 wafers a month. Wafers are the base for chips used for gadgets like TVs. Tata is also setting up packaging plants in Assam and Odisha, where chips get protected and tested.

These moves will create thousands of direct and indirect jobs, from engineers to technicians. Tata’s strategy emphasizes local talent and supply chains. They’re investing in training programs and cleanroom tech to meet global standards. This is a step toward self-reliance, inspiring other Indian firms. By blending Tata’s manufacturing process with foreign tech, they’re positioning India on the world map.

Vedanta’s Entry

Vedanta is a metals and mining powerhouse. It plans to operate in the new markets, like semiconductor fabs. They teamed up with a global electronics giant, Foxconn, in 2022 on plans to construct a $20 billion semiconductor plant in Gujarat that didn’t end well, as their partner pulled out over regulatory and tech issues. Vedanta did not give up; they announced reinvestment in 2025 with display tech and chip components for mobiles and renewables.

They’re scouting locations in industrial hubs and seeking new partnerships. Vedanta’s mining background gives it an edge in handling complex materials needed for chips. However, financial scrutiny and project delays have raised doubts. Still, their entry adds competition, pushing innovation. Vedanta proved that even non-tech firms can pivot to high-stakes industries like semiconductors.

Government support

The government is the backbone of this industry, with schemes covering half the costs for approved projects. $10 billion incentives, tax holidays, and supportive policies speed things up. Universities and companies are coming together to offer specialized courses in chip design and manufacture.

The government is collaborating with IITs and foreign experts in a move to train around 100,000 skilled workers by 2030. Among these occasions was Semicon India 2025 in September, which drew global leaders to Delhi and attracted deals.

This support is turning India from a chip importer to a maker. Policies align with “Make in India,” easing imports of machinery despite global trade tensions. The goal is to create an ecosystem where fabs, suppliers, and R&D co-exist and grow together.

Challenges ahead

Setting up fabs is tough. These facilities require a balanced environment with millions of liters of water daily and uninterrupted power. India also lacks skilled workers. The country has few experts in nanoscale manufacturing, and with high upfront costs. Supply chain is tricky, key tools come from countries like the US, restricted by the export rules.

Water scarcity in project sites such as Gujarat and environmental concerns add pressure. Competition from established players, including China and Taiwan, means India must innovate fast. For companies like Tata and Vedanta, a lack of partner reliability and funding delays poses risks.

Building a full ecosystem takes years, with expected initial losses. Experts believe that some of these problems can be fixed through smart solutions, like water recycling, vocational programs, and new policies for affordable and accessible tech.

How does it impact the Indian economy?

This semiconductor push could transform India’s economy and boost its growth. These fabs can create hundreds of thousands of direct jobs and related fields, with high salaries boosting local spending. Importing chips saves billions annually, strengthening the local economy and funding public services.

Exports can add to GDP; potentially, 1-2% growth can come from semiconductors alone. Chips are used in mobiles, EVs, and defense. It also helps in attracting FDI and upskilling youth. Rural areas near plants gain from infrastructure. This push diversifies the economy beyond IT services, making India resilient and competitive globally.

Conclusion:

India’s semiconductor push, led by Tata and Vedanta, signals a tech awakening in the country. This drive from government backing to global collaboration is building a self-reliant future. This also helps to create more jobs, innovation, and savings. The article mentioned how companies like Tata and Vedanta enable India to strengthen its semiconductor industry while making a global impact.

FAQs:

What is India’s semiconductor push?

It’s India’s effort to build and grow its own chip manufacturing industry to reduce imports and boost technology independence.

Why are semiconductors important for India?

Semiconductors are used in phones, cars, laptops, and almost all modern electronics — they’re the backbone of digital growth.

Which companies are leading India’s semiconductor race?

Vedanta, Tata Group, and CYNL are among the top players investing in chip manufacturing projects in India.

What is Vedanta doing in the semiconductor sector?

Vedanta is setting up a large semiconductor and display fab in Gujarat in partnership with international technology firms.

How is Tata Group contributing to the chip industry?

Tata Electronics is investing in chip assembly, testing, and packaging facilities to strengthen India’s chip supply chain.

Why is the government supporting semiconductor projects?

The Indian government is offering financial incentives and policies to attract investments and make India a global chip hub.

How much investment is going into India’s semiconductor push?

Billions of dollars are being invested by both Indian and global companies under government-approved projects.

When will India start producing its own chips?

The first production units are expected to begin operations around 2026–2027, depending on project timelines.

How will this help India’s economy?

It will create jobs, attract foreign investment, and make India more self-reliant in advanced technology manufacturing.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.