India Quotient raised $129 million for its fifth dedicated fund, officially designated as Fund V, from both domestic and global investors

SUMMARY

India Quotient, an early-stage venture capital firm, has already invested in the fifth committed fund, officially called Fund V, which raised $129 million. This huge capital inflow of about ₹1,132 crore has been secured through a diversified pool, which includes both domestic and international investors. The finalization of Fund V forces India Quotient to continue within the Indian startup ecosystem, as it will keep its business model of supporting nascent ideas and visionary founders at the early stage of their development.

Investment strategy and target sectors

Using the new capital, India Quotient will invest its resources in a wide range of companies that are in their foundational stages. India Quotient is particularly focused on pre-seed, seed, and idea-stage startups. This dedication to investing in the life cycle of a company at its initial stages is the core aspect of the long-term operation model of the firm.

The investment amounts that are to be planned are intended to offer essential startup funding to these growing enterprises, with an investment likely to be ₹1 crore to ₹15 crore per startup. This targeted financial approach would allow the firm to offer significant support without excessively pressuring the young businesses, which fits its general philosophy of patient and founder-friendly investment. Fund V will be used to invest in early-stage innovation and growth in the most dynamic market segments in India.

The investment thesis of India Quotient in Fund V is unconstrained by sector but focused on major high-growth sectors of the Indian economy. The company plans to allocate the capital to a variety of critical areas, which shows a clear interest in the future digital and consumer Indian environment.

SaaS (Software-as-a-Service) to support scalable business software solutions across the world and at home. Fintech to fund innovations that are disruptive to the traditional financial services and promote financial inclusion. Direct-to-Consumer (D2C) brands to invest in the upcoming generation of consumer brands that are created to cater to the digital-first Indian population.

Agritech to finance the development of technology that will transform and enhance the agricultural industry. Supplier websites of supportive platforms and companies that are transforming the creation, distribution, and consumption of digital content throughout the nation. This industry focus highlights the company’s strategy of selecting and investing in startups that respond to changing needs and consumption trends of the Indian masses and businesses.

Core approach and strategic expansion

The core of the approach of India Quotient, as the company itself describes it, lies in the commitment to assist founders even before their ideas transform into familiar, established industries. Since its establishment, this philosophy has played a key role in making the firm identify and support innovative firms in new spaces like India social, different brands, content creation, digital lending, India software, and agritech.

India Quotient has also categorically claimed it will be a patient investor with its Fund V capital. This patient model is essential to early-stage founders, as the model presupposes a deliberate attempt not to pressurize portfolio companies to deliver results such as quick up rounds, over-diluting shares, or raising liquidity too soon to a company that has not yet attained a good product-market fit.

The further strategy of the firm is to offer significant support to the founders in the idea phase and then to conduct follow-on support consistently. India Quotient is not only concerned with the growth in the high valuation but with the attainment of product-market fit and sustainable business underpinnings.

India Quotient possesses a long history of successful fundraising and deployment, having raised four previous funds leading to Fund V. Its last fund, Fund IV, was closed in 2021, at a total of $80 million, and was used to fund over 35 startups at an early stage. In the past ten years, the company has funded more than 100 startups, with many of these startups later receiving significant follow-on investor investments by large global investors, which is a testament to India Quotient’s selection track record.

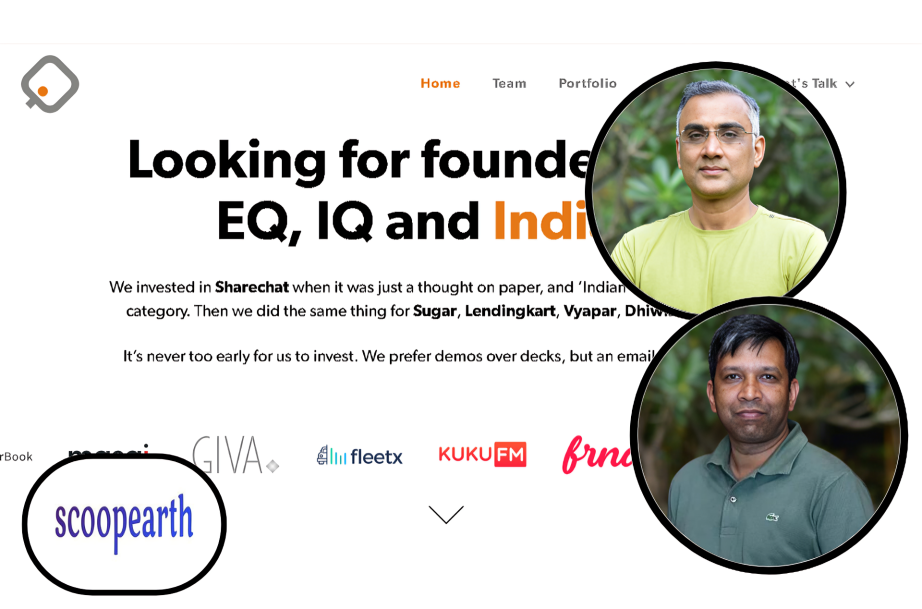

India Quotient has increased the number of its associates, including new talent, to collaborate with the current leadership. Adding to the existing partners, a new expansion team includes Kanika Agarrwal and Sahil Makkar, who will join the existing partners, namely, Gagan Goyal, Anand Lunia, and Madhukar Sinha. The growth of the core team is crucial to be able to tap into the expanded knowledge and ability to successfully incubate the new crop of early-stage ventures, so that India Quotient remains a potent force in the Indian venture capital environment.

Conclusion

The successful Fund V has raised $129 million, which is a new milestone in the history of India Quotient, and it confirms their long-term tradition of fostering the spirit of innovation in India. It has a solid investment philosophy based on patience and product-market fit, a clear strategic focus on high-potential segments such as SaaS, fintech, and D2C, and an enlarged team to implement its mandate. This most recent fund will empower India Quotient to continuously expand its influence within the Indian startup ecosystem by investing in a new generation of founders creating solutions to the Indian consumer and SME markets.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.