MPC meeting: Why did the RBI lower the repo rate ?

SUMMARY

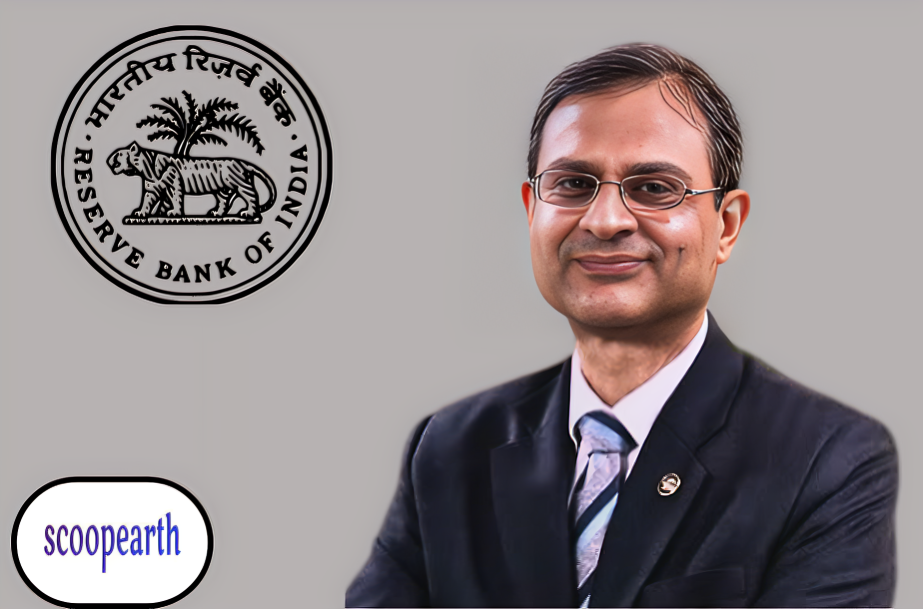

RBI Cuts Repo Rate by 25 bps — A Move to Accelerate Economic Momentum

In its December policy review, the Reserve Bank of India‘s Monetary Policy Committee (MPC) said that the repo rate will be lowered by 25 basis points, to 5.25%. Following multiple rounds of discussion between December 3 and 5, which resulted in a unanimous resolution by all six MPC members, this action was taken. Other benchmark-linked rates have also changed as a result of the primary lending rate modification. The Standing Deposit Facility (SDF) is now at 5.00%, and the Bank Rate and the Marginal Standing Facility (MSF) are at 5.50%.

Despite widespread speculation, the rate drop caused division among economists and market observers. After retail inflation fell precipitously to 0.25% in October—the lowest level in recent years—the majority of economists had initially anticipated such a reduction. However, India’s better-than-expected 8.2% GDP growth in the second quarter raised questions about the urgent need for monetary easing, leading many to speculate that the RBI would choose to pause rather than stimulate. However, the central bank startled everyone by cutting, indicating a deliberate balance between price stability and growth promotion.

How Lower Rates Accelerate an Already Strong Economy

According to the RBI, the Indian economy is about to enter a “goldilocks zone,” a unique stage in which GDP is growing at a robust 8% in the first half of FY25–26 while inflation stays low at 2.2%. Governor Sanjay Malhotra emphasized that while GDP is still strong,

several indicators point to a potential slowdown in the upcoming quarters, necessitating the strengthening of domestic demand through accommodating monetary policy.

Concerning foreign concerns, the central bank also voiced caution. Uncertain trade flows, geopolitical unrest, and worldwide volatility are still elements that could have an immediate impact on domestic GDP. Simultaneously, India is actively involved in a number of trade and investment agreements that could facilitate future cycles of upward growth if they are successfully finished. As a result, the repo rate reduction has been presented as a proactive policy to maintain economic resilience rather than a reactionary one.

Policy Stance and Growth Projections

In response to this evaluation, the MPC lowered the repo rate by 25 basis points and opted to maintain a neutral policy position, indicating flexibility to react to changing circumstances without immediately committing to tightening or further easing. The

committee now enjoys the policy leeway needed to promote growth without running the risk of price instability thanks to low inflation.

It’s interesting to note that the RBI increased the GDP growth forecast for the current fiscal year by 50 basis points, from 6.8% to 7.3%, despite global challenges and projections of a gradual reduction in demand. The robustness of domestic fundamentals, stable investment sentiment across industries, and robust consumption trends are all reflected in this improved assessment.

Position in the AI Agent Market

The startup places itself in the growing wave of AI-agent platforms that are changing workflow automation, labor, and decision-making. Phia contrasted itself with elite automation businesses like Harvey (valued at US$8 billion in legal AI), Mercor (valued at US$10 billion in HR automation), and Cursor (valued at US$29.3 billion in developer productivity) in their pitch deck. These examples show how cognitively capable AI systems are quickly growing to multi-billion-dollar valuations; Phia wants to be a part of that frontier, particularly in the consumer and commerce sector.

The history of the company itself is pretty unusual. In their Stanford dorm room, Gates and Kianni first started coming up with ideas. They first envisioned a wearable technology concept, namely a tampon with Bluetooth that would be used as a health tracking tool. The creators saw a chance to address global inefficiencies in the real world, so they quickly turned what had started out as an experimental prototype toward consumer shopping. Today, that change has evolved into a business that is drawing interest from early mass-market consumers, media figures, and venture capital executives.

Market Reactions to RBI’s Rate Cut Decision

According to Vijay Gour, Research Analyst at Mirae Asset Sharekhan, the MPC unanimously decided to lower the repo rate by 25 basis points while remaining neutral, which was reflected in the RBI’s most recent policy. Additionally, the central bank revised its forecast for FY26, cutting CPI inflation to 2.0% from 2.6% and increasing GDP growth to 7.3% from 6.8%, suggesting comfort with price stability. The RBI wants to buy USD 5 billion over three years to sustain the currency and announced a ₹1 lakh crore OMO purchase in December to relieve liquidity. Although banks may see short-term NIM pressure as a result of lower rates, Gour claims that this move is favorable for credit-driven industries like NBFCs, SFBs, MFIs, auto and housing finance, and gold lenders.

Dr. V.K. Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said the MPC’s unanimous rate cut reflects a clear push to further strengthen growth despite already strong momentum. He noted that the upgraded 7.3% FY26 GDP forecast is market-positive, indicating confidence in continued expansion. However, banks may not respond strongly as lower rates could pressure margins and make deposit mobilisation tougher. In contrast, rate-sensitive sectors like autos and real estate are well-positioned to gain quickly from reduced borrowing costs.

Conclusion

In India’s economic cycle, managed inflation has made growth-driven stimulus possible without endangering macroeconomic stability, as demonstrated by the RBI’s December monetary policy. The central bank’s intention to foster resilience, maintain momentum, and bolster domestic capacity in a world of changing difficulties is reaffirmed by the 25 basis point repo drop.

Note: We at scoopearth take our ethics very seriously. More information about it can be found here.